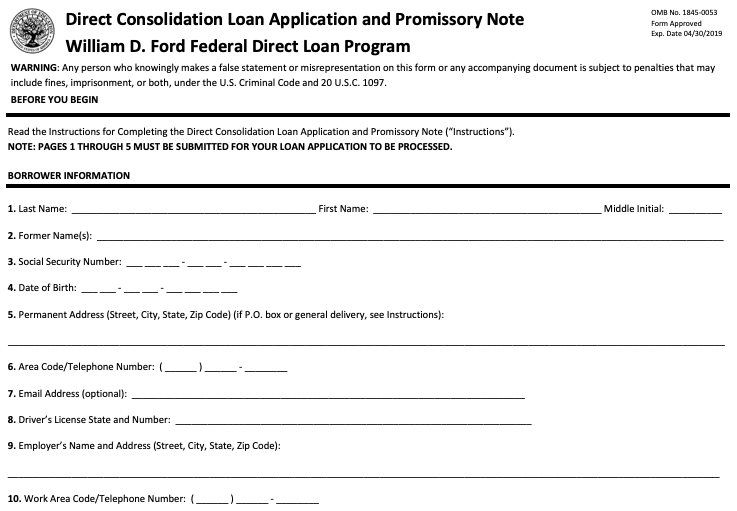

Debemos llenar este formulario cuando solicitemos el préstamo – Understanding the importance of accurately completing the loan application form is crucial for loan approval. This guide will provide a comprehensive overview of the process, including the required documentation, step-by-step instructions for filling out the form, and submission methods.

Failing to provide complete and accurate information can result in loan denials or delays. This guide will assist borrowers in gathering the necessary documents, navigating the form effectively, and submitting their application with confidence.

Understanding the Importance of Form Completion: Debemos Llenar Este Formulario Cuando Solicitemos El Préstamo

Loan applications are often the first step in obtaining financial assistance. It is crucial to complete the loan application form accurately and thoroughly to increase the chances of loan approval. Incomplete or incorrect information can lead to delays, denials, or even fraud.

Essential information typically requested in a loan application form includes personal details, income and employment history, assets and liabilities, and credit history. Providing accurate and complete information allows lenders to assess the applicant’s creditworthiness and make informed decisions.

Gathering Required Documentation

In addition to the loan application form, lenders typically require supporting documentation to verify the applicant’s information. This documentation may include pay stubs, bank statements, tax returns, and proof of identity.

Each document serves a specific purpose in the application process. Pay stubs provide evidence of income, bank statements show financial stability, tax returns indicate income and tax liability, and proof of identity verifies the applicant’s identity.

Applicants should gather and organize the necessary documentation before starting the loan application process. This will ensure that all required information is available and the application can be completed efficiently.

Completing the Form Effectively

Loan application forms can vary in length and complexity. However, there are general steps that applicants can follow to complete the form effectively:

- Read the instructions carefully before starting.

- Fill out each section accurately and completely.

- Provide all requested information, even if it is not immediately relevant.

- Avoid common errors such as leaving sections blank or providing incorrect information.

Submitting the Application, Debemos llenar este formulario cuando solicitemos el préstamo

Loan applications can be submitted in various ways, including online, by mail, or in person. Applicants should choose the method that is most convenient for them.

It is important to submit the completed form and supporting documents promptly. Lenders typically have specific deadlines for loan applications, and submitting late may result in delays or denials.

After submitting the application, applicants should follow up with the lender to check on the status of their application. This shows that they are interested in the loan and helps keep the application process moving.

FAQs

What are the most common reasons for loan application denials?

Incomplete or inaccurate information, poor credit history, insufficient income, and lack of collateral are common reasons for loan denials.

What documents are typically required to support a loan application?

Identification, proof of income, bank statements, tax returns, and credit reports are typically required.

How can I avoid errors when completing the loan application form?

Read the instructions carefully, double-check your information, and seek assistance from a financial advisor if needed.